Turn your trading

ideas into live,

automated systems

In just three weeks, master Algorithmic Trading Systems Architecture. From strategy design to execution. Gain hands-on experience in backtesting, risk management, and live deployment.

.384132f5.png&w=1080&q=75)

What You’ll Gain

Outcomes focused on real‑world skills you can deploy immediately.

Systematic Strategy Design

Learn frameworks for building robust, rules-based trading systems

Quant Tools & Pine Script

Build and test strategies confidently on TradingView.

Cloud Deployment

Deploy 24/7 bots with monitoring and failover on cloud infrastructure.

.98b135d3.png&w=640&q=75)

Risk Management

Embed risk controls and guardrails from day one.

Backtesting

Validate with historical & live data to assess reliability and robustness.

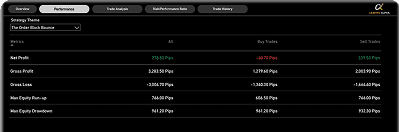

Performance

Measure edge with clear metrics, attribution, and optimization loops.

Why Join The Bootcamp

Gain practical, real-world trading experience in just three weeks, guided by experts who’ve built systems that work.

Expert Mentorship

Learn directly from quants and algo developers.

Hands-On Projects

Work on real trading automation assignments.

Community Access

Join a network of aspiring algo traders and builders.

Career-Ready Portfolio

Graduate with deployable strategies and proof of skill.

Programme Timeline

From market fundamentals to live execution, this three-week bootcamp transforms trading ideas into real, automated systems.

Week 1: Foundations of Global Financial Markets

Objective: Understand market structures, participants, and career opportunities in trading.

Evolution of Trading Systems

Welcome to the Financial Markets

Key Market Players and Operators

Career Pathways in Today’s Quant Trading Industry

Week 2: Designing and Coding Trading Strategies

Objective: Learn to design strategies, define edges, and code in Pine Script.

Basic Strategy Design Framework

Developing a Strategy with a Trading Edge

Pine Script Programming Language

Live Coding – Multi-Timeframe Trading Indicator

Week 3: Backtesting, Optimization, and Live Deployment

Objective: Test strategies, refine them, and deploy live with confidence

Fundamentals of Strategy Backtesting

Strategy Optimization Framework

Live Coding - Backtesting Trading Strategy

Live Deployment with PineConnector

Cohort Details

Your learning journey, structured for maximum impact

Schedule

- Duration: 3weeks

- Delivery Mode: Virtual

- Commitment: 6-8 hours per week

Learning Flow

- Weekdays: Self-paced learning on LMS (videos, exercises, coding labs).

- Weekends: Live revision workshops, Q&A, and peer discussions

Who This Is For

- Aspiring quant traders & system developers

- Retail traders ready to trade systematically

- Finance professionals moving into algo trading

- Students & enthusiasts exploring fintech and trading

Seats are limited—secure yours today.

Experience expert mentorship, hands-on projects, and real deployment in one intensive bootcamp.